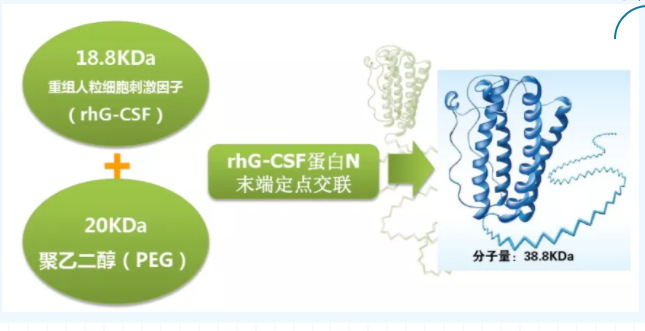

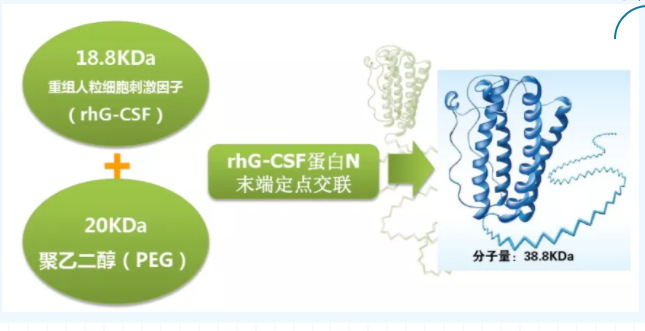

On October 8, Yifan Pharmaceutical issued an announcement that the long-acting G-CSF needle F-627 (Aibeguestine α) of Yiyi Biotech was issued by the European Medicines Agency (EMA) on September 30. With the acceptance letter, EMA officially confirmed and accepted the application for marketing authorization of F-627 for the prevention and treatment of neutropenia caused by cancer patients during chemotherapy, and entered the review process. Affected by this news, Yifan Pharmaceutical's share price closed up 6.05% on the day. F-627 is a recombinant human granulocyte colony stimulating factor-Fc fusion protein developed based on the Di-KineTM bi-molecular technology platform of Yiyi Biotech. It has long-acting and potent biological characteristics and is used to prevent and treat cancer patients caused by chemotherapy. Neutropenia. At the end of August, Yifan Pharmaceutical and Chia Tai Tianqing signed a strategic cooperation on the long-acting G-CSF injection F-627 (Aibege Sting α). Nanjing Shunxin Pharmaceutical, a subsidiary of CP Tianqing, will obtain the commercialization rights of F-627 in China, and Yiyi Bio will receive up to 210 million yuan in down payment and milestone payments, as well as double-digit tiered net sales royalties. . my country's G-CSF market has continued to expand in recent years, and long-acting G-CSF preparations are constantly eroding the short-acting G-CSF preparation market. From the perspective of the competitive landscape, the three pillars of CSPC, Qilu and Hengrui stand out, but latecomers are still pouring into this track. Shandong New Era Shenlida entered the battlefield in May. How will the future market competition of Shengbaizhen be? Long-acting vs. short-acting, who will become the dominant player in the G-CSF market? Granulocyte colony stimulating factor (G-CSF) is a glycoprotein produced by endothelial cells, macrophages and other immune cells. It contains 174 amino acids and has a molecular weight of about 19kDa. G-CSF can bind to the G-CSF receptor on the cell membrane of granulocyte progenitor cells to promote the proliferation and differentiation of neutrophils. Bone marrow suppression is a common dose-limiting toxicity of chemotherapy, of which neutropenia is the most common. G-CSF activates downstream signaling pathways such as serine/threonine kinase AKT to promote the proliferation and differentiation of hematopoietic stem cells into neutrophils, and reduce the incidence of infections manifested by febrile neutropenia. G-CSF preparations can be divided into recombinant human granulocyte colony stimulating factor (rhG-CSF) and polyethylene glycol recombinant human granulocyte colony stimulating factor (PEG-rhG-CSF). rhG-CSF is a humanized preparation artificially synthesized by G-CSF through bioengineering technology, but due to its short half-life (3.5h), it needs to be administered once a day for 7-10 days. Repeated injections aggravated adverse reactions such as bone pain, fever, and skin rash, resulting in a significant decrease in patient compliance. PEG-rhG-CSF is a long-acting preparation obtained from rhG-CSF modified by polyethylene glycol. A 20KD PEG chain is connected to the N-terminal of G-CSF amino acid. Therefore, the molecular weight of the preparation is increased from 19.6KD to 40KD, which reduces the kidney The small tube is filtered, effectively prolonging the half-life of the drug. In addition, each ethylene oxide unit in the chain can be closely associated with 2-3 water molecules, forming a highly hydrated shell-like structure in the outer shell of the protein molecule. The shell-like structure can avoid protease hydrolysis and phagocytosis by macrophages. The half-life of PEG-rhG-CSF drugs often reaches 48-60 hours, requiring only one medication in a chemotherapy cycle.

Image source: Qilu Pharmaceutical

In addition to the advantages of longer half-life, PEG-rhG-CSF is also significantly better than rhG-CSF in the prevention of neutropenia. Studies have shown that PEG-rhG-CSF can reduce the incidence of neutropenia by 71%, and rhG-CSF can also effectively reduce the incidence of neutropenia compared with placebo, but the effect is not as good as that of PEG-rhG -CSF. Therefore, whether in terms of half-life or efficacy, long-acting G-CSF is bound to replace short-acting G-CSF and become the dominant player in the G-CSF market. Table: Comparison of PEG-rhG-CSF and rhG-CSF

Why did the world's first long-acting G-CSF preparation cut its sales? The long-acting PEG-rhG-CSF was born in the 1970s, and is now widely used in foreign countries. Amgen's Pefigrastim is the world's first long-acting G-CSF preparation, with peak sales of US$4.715 billion. Amgen is deeply involved in G-CSF preparations. As early as February 1991, it launched the world’s first recombinant granulocyte colony stimulating factor filgrastim (Neupogen, G-CSF). The indications are autologous bone marrow transplantation and chemotherapy. Neutropenia and so on. However, due to the short half-life of filgrastim, in 2002, Amgen further launched a new generation of long-acting polyethylene glycol recombinant human granulocyte stimulating factor Pefilgrastim (Neulasta). By modifying the granulocyte colony stimulating factor with polyethylene glycol, the metabolism time of the drug in the body is prolonged, and the curative effect of the drug is improved. After Neulasta went public, sales were very impressive. In 2003, it achieved sales of 1.3 billion U.S. dollars and reached a peak sales of 4.715 billion U.S. dollars in 2016. However, the Neulasta patent expired in the United States in June 2015 and expired in August 2017 in Europe. The listing of biosimilar drugs had a huge impact on Neulasta’s sales. For example, the FDA approved Mylan and Coherus’s in 2018. Pefigrastim is similar to the drug market, and EC also approved the listing of Mundi Pharmaceuticals' Pefigrastim biosimilar in the same year. Faced with the challenge of biosimilar drugs, Neulasta’s sales continued to shrink. In 2020, it only achieved sales of US$2.293 billion, a year-on-year decline of 29%, which has been cut from peak sales. The scale of the domestic G-CSF market has increased by three times. What is the competition? my country's PEG-rhG-CSF has been on the market late. Before 2016, the G-CSF market was mainly monopolized by short-acting G-CSF, but the market growth rate was slow. In recent years, long-acting G-CSF preparations are accelerating market substitution, and due to the high price of long-acting G-CSF, the total market size of G-CSF is rapidly increasing. The market size of sample hospitals in 2020 has reached 3 billion yuan, compared with 900 million in 2015 The market scale has increased by 3 times. At present, my country has four long-acting G-CSF preparations approved for marketing. From the analysis of the competitive landscape, Sinopharm’s Jinyouli, Qilu Pharmaceutical’s Xinruibai and Hengrui Pharmaceutical’s Aili are three pillars. Among them, Jinyouli and Xinruibai’s sales are equal and ahead of Aili. The sample hospital in 2020 Sales reached RMB 1 billion. However, Aili is gaining momentum and is catching up. After being included in medical insurance in 2019, the volume has increased rapidly. In 2020, the sample hospitals achieved sales of 432 million yuan. In addition, in May 2021, Shandong New Era's PEGylated human granulocyte stimulating factor injection (Shenlida) under Lunan Pharmaceutical was approved for marketing, becoming the fourth domestically-made long-acting whitening needle. G-CSF market sample hospital sales

(million dollar)

Data source: PDB

(1) Qilu Pharmaceutical is a leading company in the field of G-CSF in China. In 1999, it was the first to launch the recombinant human granulocyte stimulating factor injection "Ruibai". Ruibai once occupies 40% of my country's whitening market, but due to short half-life and adverse reactions caused by multiple injections, Qilu spent 30 million yuan to develop a long-acting granulocyte stimulating factor-Xinruibai after 10 years . On August 26, 2015, Xinruibai was approved for listing by NMPA, which opened the long-term era of granulocyte stimulating factor in my country. In 2017, Xinruibai was included in the medical insurance, and the current price is about 1,620 yuan per bottle.

Picture: New Ruibai

Data source: Qilu Pharmaceutical

(2) Jinyouli was developed by CSPC and was approved by CFDA in 2011. It is the first long-acting whitening needle in China, filling the gap in domestic long-acting whitening needles. Jinyouli was included in the national medical insurance in 2017, and the price is the same as that of Xinruibai, both of which are 1,620 yuan per stick.

Picture: Jinyouli

Data source: CSPC

(3) Thiopefilgrastim was developed by Hengrui Pharmaceuticals and was approved by the NMPA in May 2018, under the trade name Aido. Thiopefilgrastim is a long-acting recombinant human granulocyte stimulating factor preparation modified with polyethylene glycol on the basis of filgrastim. It is clinically used to reduce the clinical manifestations of febrile neutropenia. Infection rate. Compared with other long-acting G-CSF preparations, Thiopefilgrastim has a more stable structure, less ADA, lower immunogenicity, safety and reliability. In 2019, the price of Thiopefilgrastim was reduced by 46% from 6,800 yuan to 3680 yuan, and it was successfully included in the national medical insurance catalogue. Recently, Hengrui Medicine obtained the rights of Dalian Wanchun GEF-H1 activator prinabulin. In the future, it will further explore the efficacy of prinabulin combined with thiopefigrastim to prevent neutropenia. Figure: Structure of Thiopefilgrastim

Data source: Hengrui Medicine

summary With the continuous increase of cancer patients, my country's G-CSF market space is rapidly increasing. Studies have shown that my country's G-CSF market has reached 9.59 billion yuan in 2020, with a compound growth rate of 12.57% from 2017 to 2020. Compared with the short-acting G-CSF, the long-acting G-CSF significantly reduces the frequency of administration, and the patient's dependence is significantly improved. With this advantage, long-acting G-CSF is accelerating the replacement of short-acting G-CSF, and gradually dominate the Shengbai needle market. From the perspective of the competitive landscape, Qilu Pharmaceutical, CSPC and Hengrui Pharmaceutical are currently in a three-pronged manner, but with the entry of new players, the layout is expected to change. In addition, looking forward to the future, Hengrui Pharmaceuticals and Dalian Wanchun are expected to further expand their market share by virtue of the combined solution. Yiyi Bio's third-generation long-acting G-CSF is expected to shine in the commercial cooperation with Zhengda Tianqing . What the future holds, let us wait and see.

![]() October 12, 2021

October 12, 2021