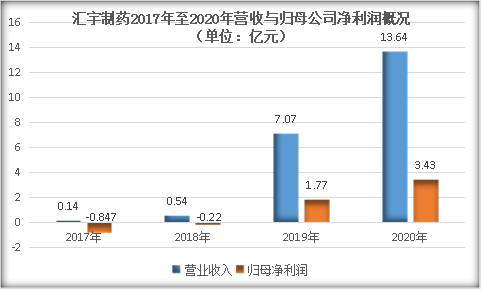

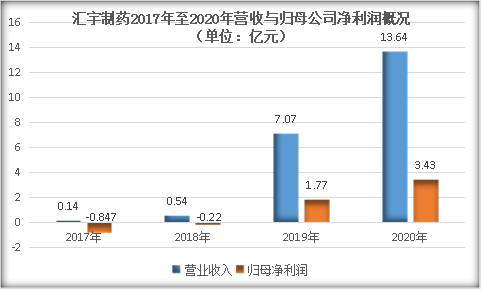

On October 18, Huiyu Pharmaceutical issued a prospectus for listing on the Science and Technology Innovation Board. Its initial public offering of shares began on October 12 and ended on October 14. The price of this stock is 38.87 yuan per share, and the number of shares issued is 63.60 million shares. According to previous disclosures, it plans to raise 1.907 billion yuan for capacity expansion, research institute construction and supplementary working capital. Huiyu Pharmaceutical is a comprehensive generic drug company focusing on the production, R&D and sales of high-end anti-tumor drugs and injections. It was established in 2010 in Neijiang City, Sichuan Province. Its main products include pemetrexed disodium for injection and doxyl Including metoxetin injection, zoledronic acid injection, irinotecan hydrochloride injection, etc. Centralized sourcing benefits, performance takes off, but relying on a single product to boost performance continues to be under pressure According to the financial data of the prospectus, from 2017 to 2020, Huiyu Pharmaceutical's operating income and net profit attributable to the parent company have been rising steadily, achieving revenues of 13.983 million yuan, 54.320 million yuan, 707 million yuan, and 1.364 billion yuan, respectively. -84.7184 million yuan, -22.04 million yuan, 177 million yuan, and 343 million yuan. In addition, the achievable operating income range from January to September 2021 is between 1.36 million yuan and 1.410 million yuan, an increase of 36.05%-41.06% compared to the operating income of the same period in 2020; it is expected to be attributable to the parent company from January to September 2021 Shareholders’ net profit is between RMB 360 million and RMB 390 million, an increase of 35.85%-47.17% compared to the net profit attributable to shareholders of the parent company in the same period in 2020

It is not difficult to see that 2018 is a dividing line, and Huiyu Pharmaceutical's performance in 2019 has grown rapidly. It is reported that up to now, Huiyu Pharmaceuticals has a total of 7 blockbuster generic injections approved for marketing in the country and passed the consistency evaluation, of which 6 have won the bid for the centralized procurement of countries, and their performance can rapidly soar. Greater market dividends are closely related, especially its core product pemetrexed disodium, which won the exclusive bid with a 65% price reduction in the “4+7” volume procurement and the alliance area volume procurement in 2018, and seized the market share of the original research. Sales have been increasing steadily, and sales in 2020 will be 42 times that of 2018, and revenue will account for more than 90% of revenue from 2019 to 2020.

Sales unit: 100 million yuan

It is worth noting that with the "4+7" volume purchase of pemetrexed disodium at the end of this year and the expiration of the bid period for volume purchases in alliance areas, pemetrexed disodium is no longer the only company that has passed the consistency evaluation. Enterprises (According to Yaozhi data, up to now, including Huiyu Pharmaceuticals, a total of 7 enterprises have passed or deemed to have passed the consistency evaluation, including Hausen and Qilu Pharmaceuticals, which have the top market share). At that time, the company's product may not be able to successfully renew the bid, and even if it wins the bid, it will significantly reduce the price of the drug. For example, on January 29, 2021, Hubei Province will bid for 8 varieties including pemetrexed disodium for injection with no more than 2 selected enterprises in the first batch of centralized procurement in the alliance area and a procurement cycle of one year. The winning bid for pemetrexed disodium was Qilu Pharmaceutical's 198 yuan/piece, which was 75.19% lower than the winning bid price of 798 yuan/piece in the Huiyu Pharmaceutical Union area. In addition, Huiyu Pharmaceutical is not an integrated company of raw materials and preparations. If the supply of raw materials from upstream suppliers is insufficient, it will also face the situation of insufficient supply of corresponding raw materials at any time. For various reasons, the sales of pemetrexed disodium will decline. When Huiyu Pharmaceuticals relies heavily on pemetrexed disodium to drive its performance, its performance will definitely be affected. Therefore, Huiyu Pharmaceuticals The rapid increase in performance under “quantity procurement” may not be a long-term solution, and it is doubtful whether the subsequent profitability will continue. However, the prospectus of Huiyu Pharmaceuticals also shows that its company will use its insight into the differences between domestic and foreign industries, forward-looking layout and accumulation, efficient R&D, and the large-scale R&D market, with higher technical difficulties, and less competition. Under the circumstances, the method of entering the pipeline with volume procurement focuses on the consistency evaluation of injections, ensuring the continuity and stability of the company's products in the two key aspects of consistency evaluation and bid winning, so as to ensure the continuous growth of the company's performance. Can innovation be driven by imitated cultivation and diversified layout? Mr. Ding Zhao, the founder and general manager of Huiyu Pharmaceuticals, also stated at the online investor exchange meeting for initial public offerings and listing on the Science and Technology Innovation Board that innovative drugs will be taken as an important development strategy to form The pattern of international mutual support. At present, the company has more than 87 research projects, including 10 first-class innovative drugs and 1 improved new drug project. In the short term, Huiyu Pharmaceuticals will continue to develop generic drugs and complex injections, and focus on the development of innovative biological and chemical drugs. Overview of Huiyu Pharmaceutical's R&D pipeline in the oncology field

According to the prospectus, the R&D investment has been continuously increased from 2018 to 2020, from 39,149,800 yuan to 88,773,900 yuan. However, the growth rate of its R&D expenses has not been able to keep up with the revenue rate, and the proportion of revenue has decreased year by year, respectively. They were 72.07%, 7.87%, and 6.51%. It is because the company’s operating income has grown rapidly in 2019, but the expansion of the R&D team and the increase of R&D projects require a certain period of time to gradually advance. Therefore, the company’s R&D expenses as a percentage of operating income has shown a downward trend year by year, but the absolute value of R&D investment Value will maintain rapid growth, especially after innovative drugs enter the clinical research phase, the growth of R&D costs will further accelerate. Huiyu Pharmaceutical's R&D investment details in recent years

Image source: prospectus

However, the proportion of R&D expenses in revenue has "drifted down", which has also caused concerns from the outside world that it is a company that "emphasizes sales and neglects R&D". After all, the amount of academic promotion fees for Huiyu Pharmaceuticals from 2018 to 2020 has been year by year. There has been a sharp increase, especially under the new crown epidemic in 2020, academic promotion expenses have not fallen but increased, respectively, which are 17.25331 million yuan, 303 million yuan and 645 million yuan, accounting for approximately 58.25%, 89.7%, and 645 million of each period of sales expenses, respectively. 90.39%. Therefore, whether Huiyu Pharmaceutical can take the path of "innovation by imitation", drive innovation, and achieve breakthroughs, we have to wait and see! Source: Huiyu Pharmaceutical's official website, prospectus

![]() October 21, 2021

October 21, 2021